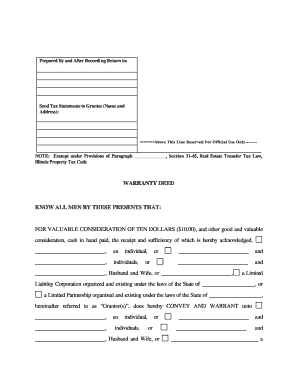

The list of exemptions is provided in our office, on our website, or in the Illinois Compiled Statues (Chapter 35 ILCS, Section 200/31-45 exemptions). When recording a deed with money transferred, the recording fee and the transfer must be paid separately when paying by check. The County of Madison collect $.25 per $500 or part thereof of taxable consideration. The State of Illinois collects $.50 per $500 or part thereof of taxable consideration. The PTAX Declaration requires you to calculate the net taxable consideration subject to transfer tax.įor further information which affects ground leases and transfers of beneficial interest, refer to Chapter 35 ILCS, Revenue, Act 200 Property Tax Code, Article 31. The Real Estate Transfer Declaration is available in our office. When recording any deed of trust document, it must be accompanied by an Illinois Department of Revenue Real Estate Transfer Declaration (PTAX) or a Statement of Exemption.

Other chapters not noted may also affect deed recordings

Deeds, Mortgages, Release and Other Instrumentsġ. Document Types Recorded in the Recorder's OfficeĬertificate of Change of Registered Agent & OfficeĢ. Deeds, Mortgages, Release and Other Instrumentsĭeed, mortgages, releases are the most common type documents recorded in our office and make up the greatest percentage of our recordings.įor information on recording a deed or trust document you may refer to the Illinois Compiled Statutes, Chapter 765 ILCS, Property, Chapter 55 ILCS, Article 3, Division 3-5 Recorder, and Chapter 35 ILCS, Revenue.Document Types with Codes for Searching.Document Types Recorded in the Recorder's Office.Training & Employment Opportunity - Metro Area.

Request or Review Madison County Public Records - FOIA.

0 kommentar(er)

0 kommentar(er)